The Origins of Coinage in Ancient Civilizations

From Barter to Bold Innovation

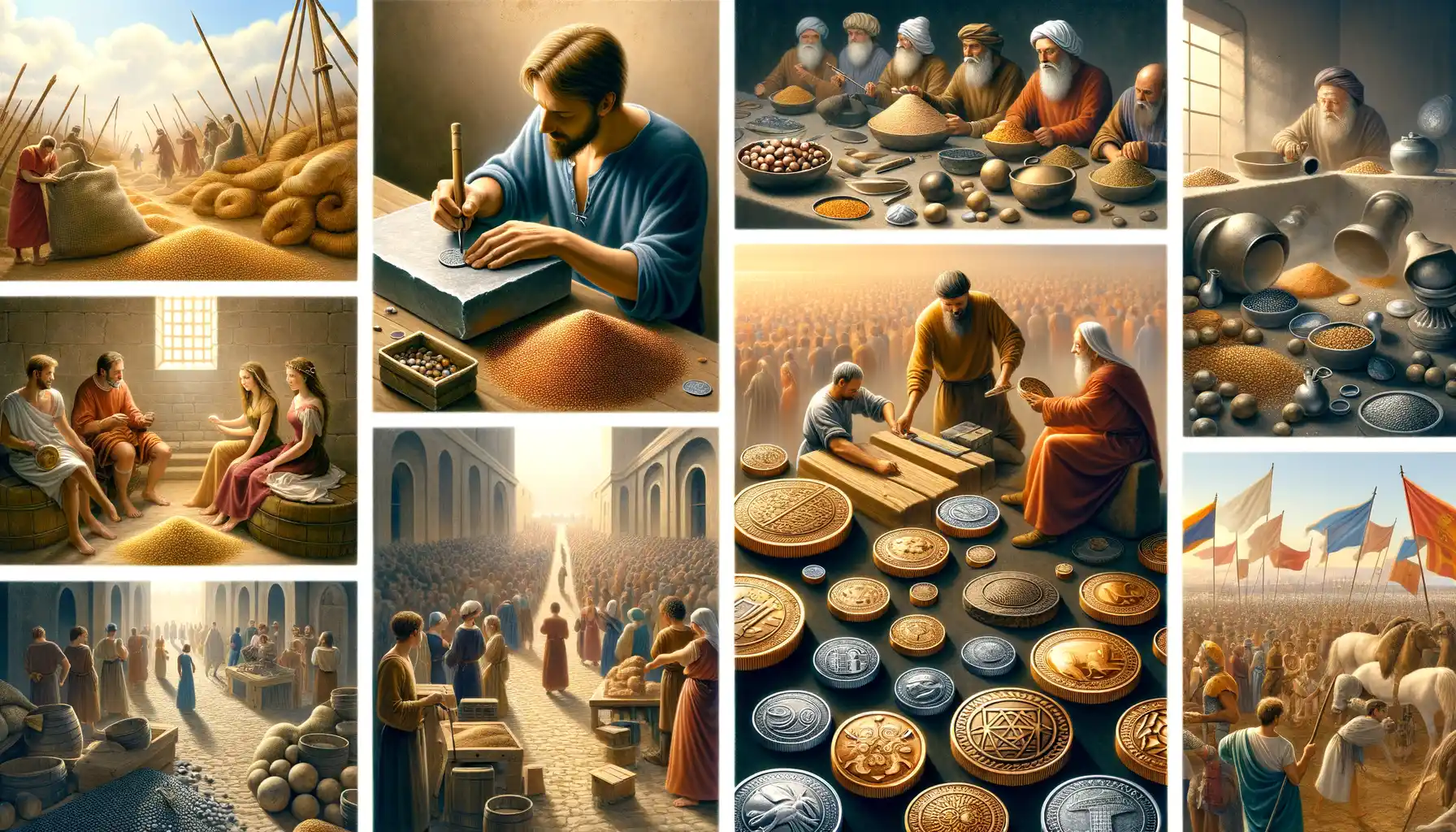

Imagine it: a bustling marketplace in ancient Mesopotamia, where merchants exchanged goods with shells, grains, or livestock. It worked, sure—but it wasn’t exactly elegant. Enter the game-changer: **coinage**. Around 3,000 years ago, early civilizations like the **Lydians, Chinese, and Greeks** got creative. Instead of swapping sheep for pots or bags of grain, they crafted something far more practical—small, shiny tokens stamped with official marks.

The idea was revolutionary. Coins weren’t just money; they were symbols of trust. Everyone understood their value, from fishermen trading in Sardis to farmers in ancient China. **The Lydians**, often celebrated as the first to mint coins, used precious metals like gold and silver. What’s more memorable than holding real value in your hand?

- In China, metal coins shaped like tools mirrored their agricultural roots.

- In Greece, beautifully stamped drachmas became cultural emblems, blending art with economy.

A Snapshot of Creativity and Power

Coins did more than simplify trade. They showcased power. Leaders imprinted their faces and gods onto them, spreading influence with every transaction. Think of a merchant in **Rome**, turning over a denarius, seeing Caesar’s face—proof that currency could both connect and command entire societies.

The Development of Coinage in the Middle Ages

The Coins That Shaped Medieval Life

Picture bustling medieval marketplaces, where bartering gave way to jingling purses filled with coins. The Middle Ages were a transformative period for currency, marked by innovation and the surprising quirks of the time. Unlike the ancient world’s focus on empires, medieval coinage was often hyper-local. A single city or noble family might mint its own coins, each stamped with unique designs that acted as symbols of power and identity.

Coins became synonymous with trade and trust—but there was also chaos. Imagine the confusion when merchants traveling across regions encountered unfamiliar coinage. To navigate this maze of currencies, traders relied on money changers, early predecessors of today’s banks. These professionals assessed the value of coins from different realms, calculating what was worth its weight in gold—or silver.

The Rise of Gold and Silver Dominance

In the hustle and bustle of medieval Europe, it wasn’t just the coins themselves that mattered—it was the material they were made of. Gold coins like the Venetian ducat and Florence’s famed florin became coveted symbols of stability. Why? Their consistent quality and durability stood out, even as lesser alloys tarnished over time.

During this era, certain crises fueled change:

- The collapse of the Roman Empire led to regional reinvention of money-making traditions.

- Viking raids introduced exotic Arabic dirhams to the northern reaches of Europe.

- The Crusades saw the West encounter Eastern coinage, sparking shifts in design and standards.

Coinage wasn’t static; it was alive, evolving alongside the ambitions and fears of medieval society. So next time you hear the clink of a coin, think back to knights, kings, and bustling bazaars—it’s history in your pocket.

The Transition to Modern Coinage Systems

Dawn of a New Era in Coinage

Picture it: the clinking coins of the Renaissance giving way to the sleek precision of machine-struck currency. The transition to modern coinage wasn’t just about minting prettier or sturdier coins—it was a revolution, an upheaval of centuries-old traditions. Gone were the irregular shapes and hand-stamped symbols; in their place came perfectly round, standardized coins that felt almost futuristic to those living in the 17th and 18th centuries.

Why such a shift? Well, imagine trying to run an international trade system with coins that varied wildly in weight and purity. Chaos. Enter technological advancements like the screw press and later the steam-powered press, which transformed production. Governments now had greater control over quality and design. A nation’s coins became more than just money—they were propaganda tools, emblazoned with rulers’ profiles and national emblems that told stories in silver and gold.

- The 1790s: The Royal Mint in London introduced steam-powered coin presses, producing coins with unmatched precision.

- Metal alloys: Silver and gold weren’t the only stars anymore; copper and nickel joined the cast for practicality.

The Birth of Trust in Currency

Modern coinage wasn’t just about metal and machinery—it redefined trust. You could finally hold a coin and *know* its value. And that trust? It laid the foundation for today’s global economy.

The Role of Technology in Coin Evolution

From Metal to Machines: A Technological Revolution

Imagine a world where coins are minted by hand—hammered, shaped, and engraved by skilled artisans with nothing but their tools and determination. That’s how it all began. But today? The process has become a symphony of precision machines, lasers, and AI-guided systems. Technology didn’t just refine coin-making—it redefined it.

Take modern minting as an example. Nations like the United States use cutting-edge robotic arms in their mints to churn out millions of coins daily, each one flawless and identical. Now contrast that with centuries past, when even slight differences between two coins could cause chaos in trade. Talk about night and day!

- Automated minting: Machines stamp coins at blinding speeds, ensuring consistent weight and purity.

- Laser engraving: Designs so intricate they’d leave ancient engravers speechless—think holographic patterns and ultra-secure microtext.

- AI quality control: Every coin scanned to detect imperfections invisible to the human eye. Perfection, practically guaranteed.

When Security Meets Sci-Fi Innovation

Here’s where it gets futuristic. Modern coins don’t just sit in your pocket—they’re fighters on the front lines of counterfeit prevention. Countries embed advanced electromagnetic signatures and nanoparticle materials into their designs. Take the Canadian $1 coin—the “Loonie.” Its layers of metals create a digital fingerprint that’s nearly impossible to replicate. Isn’t it fascinating how something so small carries technology powerful enough to outwit counterfeiters worldwide?

This is where the past meets the future: ornate Roman denarii may have had charm, but today’s coins? They carry secrets only computers can decode.

The Future of Currency and Digital Coinage

The Age of Decentralized Dreams

Imagine holding the future in your pocket—not coins of copper or paper notes, but something entirely intangible yet undeniably powerful. Welcome to the world of digital currencies, where the clinking of metal and rustle of bills give way to clicks and keystrokes. These currencies are reshaping everything we thought we knew about money.

Unlike traditional forms of payment bound by geography and intermediaries, digital coinage is borderless and fiercely independent. Think of Bitcoin, often referred to as “digital gold,” or Ethereum, a platform that’s as much about innovation as it is about transactions. But this isn’t just about buzzwords or tech-savvy jargon—it’s about empowerment.

- No middlemen skimming fees off the top.

- No waiting days for bank transfers to clear.

- No barriers like currency conversions holding progress hostage.

Isn’t that a tantalizing prospect? A single digital wallet on your phone could do what entire financial institutions once did, at a fraction of the cost and time. The shift feels almost poetic—like moving from steam engines to rockets.

Technology Meets Trust

But here’s the kicker—this revolution isn’t just about speed or convenience. It’s about reimagining trust itself. Systems like blockchain create decentralized ledgers, ensuring transactions stay transparent and secure. Picture this: no one person or entity “owns” the system, yet it functions flawlessly.

Governments and corporations alike are catching on. Some countries are piloting Central Bank Digital Currencies (CBDCs), blending the innovation of crypto with the reliability of state-backed money. Meanwhile, companies like Tesla and PayPal have dipped their toes into the crypto world, hinting at its mainstream acceptance.

What’s in your wallet today—a couple of crumpled bills or the building blocks of tomorrow’s economy? This isn’t just evolution; it’s a revolution in the making.